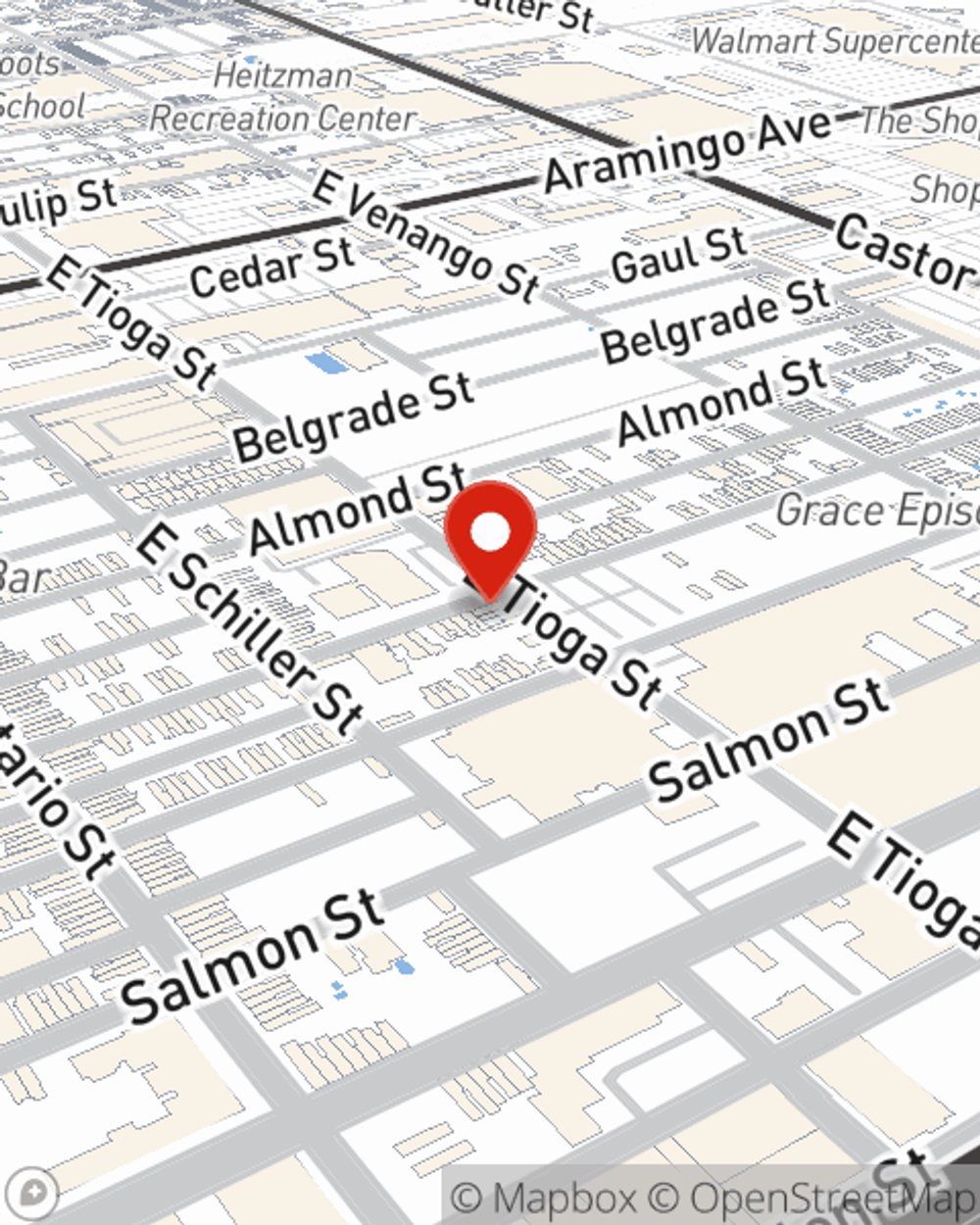

Business Insurance in and around Philadelphia

One of the top small business insurance companies in Philadelphia, and beyond.

This small business insurance is not risky

This Coverage Is Worth It.

Do you own a photography business, a yogurt shop or a book store? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on what matters most.

One of the top small business insurance companies in Philadelphia, and beyond.

This small business insurance is not risky

Customizable Coverage For Your Business

Your small business is unique and faces a wide array of challenges. Whether you are growing a bagel shop or a deli, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Dan O'Mara can help with errors and omissions liability as well as mobile property insurance.

Since 1935, State Farm has helped small businesses manage risk. Call or email agent Dan O'Mara's team to identify the options specifically available to you!

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Dan O'Mara

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.